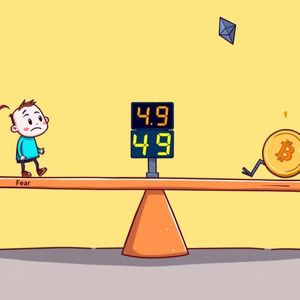

BitcoinWorld Unlocking the Crypto Fear & Greed Index: What 49 Means for Your Investments Are you looking to understand the pulse of the cryptocurrency market? The Crypto Fear & Greed Index is a vital tool for many investors, offering a snapshot of current market sentiment. Recently, this crucial indicator rose one point to 49, firmly placing it in the neutral zone. This subtle shift provides valuable insights into how participants are feeling about their crypto holdings. What is the Crypto Fear & Greed Index and How Does it Work? The Crypto Fear & Greed Index , provided by Alternative.me, is designed to gauge the overall emotional state of the crypto market. It helps investors understand whether the market is leaning towards extreme fear or extreme greed. When the index approaches 0, it signals extreme fear, often indicating potential buying opportunities. Conversely, an index near 100 suggests extreme greed, which can sometimes precede a market correction. But how exactly is this fascinating metric calculated? It’s not just a random number; it’s a weighted average of several key market factors. Each factor contributes to the overall score, providing a comprehensive view of sentiment: Volatility (25%): This measures the current volatility and maximum drawdowns of Bitcoin, comparing them to average values over 30 and 90 days. Higher volatility often signals fear. Market Volume (25%): High trading volumes in a positive market typically indicate greedy behavior, while low volumes can suggest fear or indecision. Social Media Mentions (15%): The volume and sentiment of cryptocurrency-related hashtags on social media platforms are analyzed. A surge in positive mentions can signal greed. Surveys (15%): While currently paused, these polls directly ask crypto investors about their market outlook, providing a direct sentiment reading. Bitcoin Dominance (10%): An increase in Bitcoin’s market dominance can indicate fear, as investors might be shifting away from altcoins into the perceived safety of Bitcoin. Google Search Trends (10%): Analyzing search queries related to cryptocurrencies helps identify retail investor interest. A spike in searches for terms like ‘Bitcoin price manipulation’ might suggest fear. Why is the Crypto Fear & Greed Index at 49 Significant? The current reading of 49 places the Crypto Fear & Greed Index squarely in the neutral territory. This position is quite interesting because it suggests a balanced market, where neither extreme panic nor irrational exuberance is dominating. Unlike the volatile swings between ‘extreme fear’ and ‘extreme greed’ that often characterize crypto, a neutral stance can offer a period of consolidation and thoughtful consideration for investors. A neutral reading implies that market participants are not making decisions based purely on emotion. Instead, there might be a more rational assessment of market conditions, fundamental values, and technical indicators. This can be a healthier environment for sustained growth, as opposed to speculative bubbles or panic-driven sell-offs. For investors, this neutral zone can represent an opportunity to re-evaluate strategies without the pressure of extreme market sentiment. It’s a moment to observe, plan, and potentially make calculated moves rather than reactive ones. Understanding this balanced state is crucial for long-term success in the dynamic crypto landscape. How Can You Leverage the Crypto Fear & Greed Index for Better Decisions? While the Crypto Fear & Greed Index is a powerful indicator, it’s essential to use it as part of a broader investment strategy, not as a standalone signal. Here are some actionable insights: Counter-Cyclical Investing: Many successful investors use the index as a contrarian indicator. They consider buying when the index signals ‘extreme fear’ and selling or taking profits when it signals ‘extreme greed’. Risk Management: A high ‘greed’ score might prompt you to review your portfolio’s risk exposure, perhaps reducing positions in highly speculative assets. Conversely, ‘fear’ could be a time to consider dollar-cost averaging into promising projects. Market Confirmation: Use the index to confirm your own analysis. If your research suggests a bullish trend but the index shows extreme fear, it might indicate an undervalued opportunity. If your research points to a top and the index shows extreme greed, it reinforces your caution. Avoid Emotional Trading: The primary benefit of the index is to help investors detach from their own emotions. By providing an objective measure of market sentiment, it encourages more disciplined decision-making. However, remember that the crypto market is complex. The index is one piece of the puzzle. Always combine its insights with thorough fundamental and technical analysis, and consider your personal financial goals and risk tolerance. Conclusion: Navigating the Neutral Zone with Confidence The Crypto Fear & Greed Index holding at 49 in the neutral zone offers a fascinating glimpse into the current state of the cryptocurrency market. It suggests a period where emotions are not running rampant, allowing for more rational and strategic decision-making. By understanding how this index is calculated and what its readings imply, investors can gain a significant edge in navigating the often-turbulent waters of crypto. Whether you’re a seasoned trader or new to the space, using tools like the Crypto Fear & Greed Index can empower you to make more informed choices, reduce emotional trading, and ultimately, build a more resilient investment portfolio. Stay vigilant, stay informed, and always approach the market with a well-thought-out plan. Frequently Asked Questions (FAQs) Q1: What does a ‘neutral’ reading on the Crypto Fear & Greed Index mean? A ‘neutral’ reading, like 49, indicates that the market is not dominated by extreme fear or extreme greed. Investors are likely making more rational decisions, and the market may be in a period of consolidation or balanced sentiment. Q2: Is the Crypto Fear & Greed Index only based on Bitcoin? While Bitcoin’s market dominance is one factor, the index considers broader market data, including volatility, trading volume, social media, and Google trends across the cryptocurrency ecosystem, not just Bitcoin specifically. Q3: Can I use the Crypto Fear & Greed Index to predict market tops and bottoms? Many investors use the index as a contrarian indicator, viewing ‘extreme fear’ as a potential buying opportunity and ‘extreme greed’ as a potential selling opportunity. However, it should be used in conjunction with other analytical tools, not as a sole predictor. Q4: How often is the Crypto Fear & Greed Index updated? The index is typically updated daily, providing a fresh perspective on market sentiment for the current day. Q5: What are the main factors that influence the Crypto Fear & Greed Index? The index is calculated based on volatility, trading volume, social media mentions, surveys, Bitcoin’s market dominance, and Google search trends, each weighted differently. Q6: Does the index consider news events? Indirectly, yes. Major news events can influence volatility, trading volume, social media sentiment, and Google search trends, which are all components of the index’s calculation. If you found this article helpful, consider sharing it with your friends and fellow crypto enthusiasts on social media! Your shares help us reach more people who are eager to understand the fascinating world of cryptocurrency. To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action. This post Unlocking the Crypto Fear & Greed Index: What 49 Means for Your Investments first appeared on BitcoinWorld and is written by Editorial Team